Cyber risk and exposure to criminals operating in the digital realm is becoming increasingly problematic for professional service providers – financial advisers in particular. So, with this in mind, why shouldn’t you buy Cyber Insurance?

Actually, you should, but not where you might think. Advisers often look to include either all, or some of their Cyber risk within their main PII program.

We think blending Cyber coverage into PII is full of traps for a few reasons;

Coverage

PII coverage is designed to cover a breach of professional duty – if you make a mistake and need to compensate a client, PII acts as a safety blanket should your best efforts to resolve the situation fail. However, PII isn’t good at dealing with the myriad of issues that come with Cyber breaches. The coverage offered under cyber extensions is usually thin and largely inadequate – it’s a token and, for such a critical exposure – generally not appropriate.

Claims

PII insurers are generally not equipped to deal with Cyber claims as and when they happen. Claims management in PII is a slow-moving beast; Cyber claims are time-critical and usually need professional support when events occur. Good cyber insurers offer 24-hour support with forensic professionals who can manage an extortion or theft/social engineering event quickly and with a very high degree of proficiency.

Church and State

Separation of these key exposures – Cyber events like data breaches, extortion, social engineering, or email impersonation, and advice, are critical to ensuring that your main PII program isn’t impacted negatively. PII carries much higher premium costs, so for exposure like Cyber (which has a higher likelihood of occurrence), ring-fencing this into a separate and standalone policy with better cover and lower annual premium costs means that if a Cyber claim does occur, it won’t have an impact on the PII program and is generally going to operate with a much lower excess.

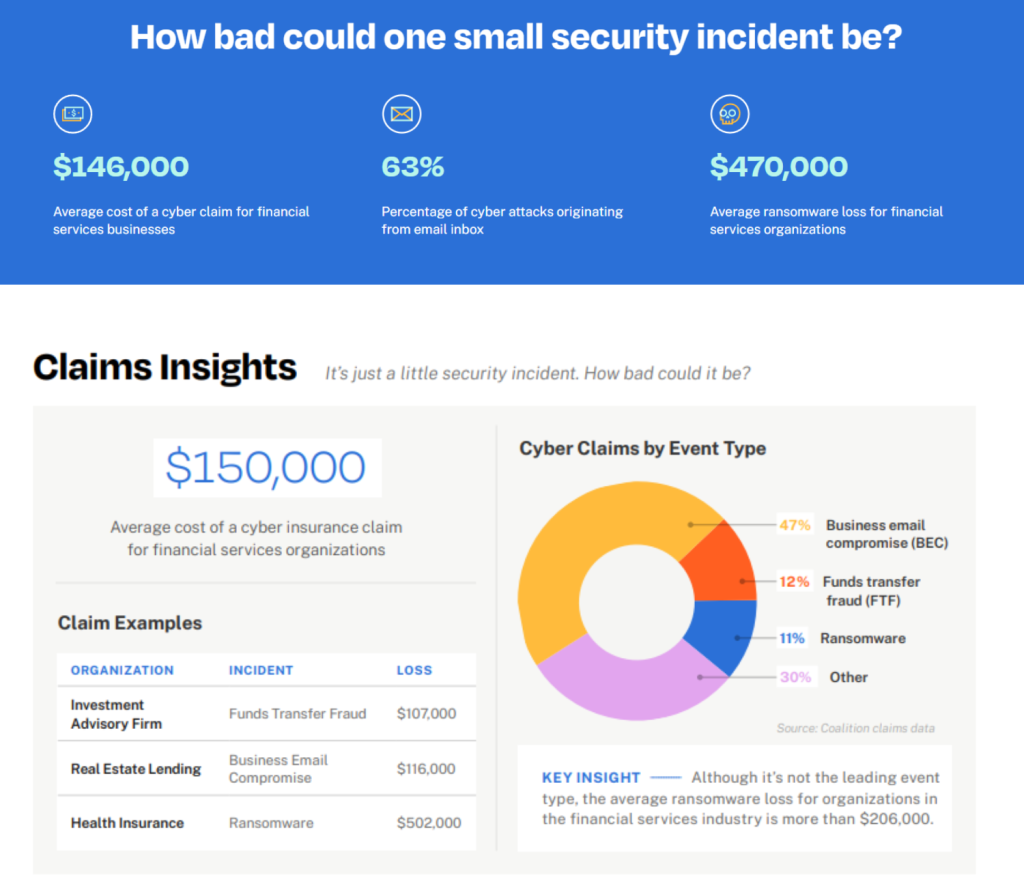

If you aren’t convinced, then perhaps some of the data might change your mind. New local Cyber Insurance market entrant Coalition has experience across Australia, the US, UK, Canada and Germany;

*values are quoted in USD.

Numerisk are specialists in the Wealth sector and can take financial planning firms through a discussion on how best to manage some of the exposures and risks inherent in advice.

Improve your insurance outcome, get in touch.

Get in touch with our team to have a chat about your risk exposures and the solutions we can offer to improve your insurance outcome.

Book a 30-minute consultation with us.

Call us on 1300 001 283

Or email enquiry@numerisk.com.au